Sorry, Suze Orman. We Disagree.

Suze Orman is an excellent resource for people seeking tried-and-true financial advice. She’s a bestselling author, columnist, and speaker. She knows her stuff. But that doesn’t mean we can’t take issue with her advice.

For instance, in her recent blog post, Suze says this about refinancing:

“The big mistake is that after spending years paying down their existing 30-year mortgage, people then refinance into a new 30-year mortgage. This is so very wrong. Let’s say you have been paying your original mortgage for 14 years. Now you decide to refinance and you take out a fresh 30-year mortgage. Sure, the new mortgage is at a lower interest rate, but you just extended your mortgage-payment on this home to 44 years! That’s 44 years of interest payments.”

OK, Suze, we get it. What you’re saying makes sense — but only if you’ve been financially stable for quite some time with considerable savings in the bank. That, however, is not the world we’re living in these days.

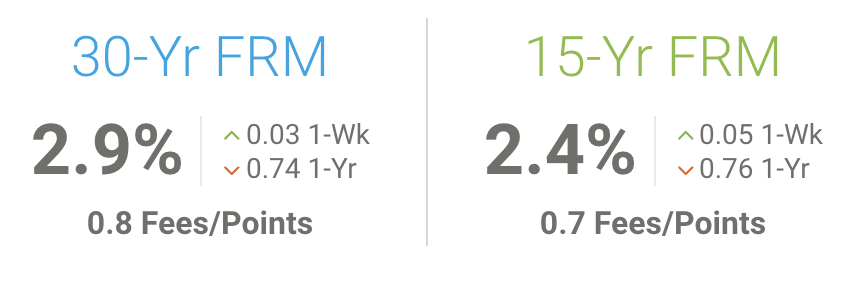

A refinance relieves the stress of mounting debt that plagues so many people who have been directly affected by the pandemic, whether it’s job- or health-related. Because we’re in a period of historically low rates, a refi will beat any bank loan you could hope to get.

The people I have worked with are looking for the financial relief a refinance provides. No one should feel ashamed for seeking help, even if they have made poor financial choices in the past. We’re not all perfect. Not even Suze.

If you’d like to chat about mortgage options, please call me at 617-965-1236. If you’re planning to buy this year, let’s talk soon. I look forward to speaking with you.

Ready to buy a new home or refinance the one you own? Please get in touch and I’ll be happy to answer your questions and help guide you through the process. I look forward to speaking with you.

Home Improver: Is the Water Table Rising?

This has been one of the rainiest springs and summers in a long time. What does that mean for the water table? Is it rising? How can it affect your home?

This has been one of the rainiest springs and summers in a long time. What does that mean for the water table? Is it rising? How can it affect your home?

Let’s start with a definition, from our friends at National Geographic:

“Well beneath the ground, at various depths depending on geography, topography and weather conditions, pockets of water, called aquifers, exist. The water table marks the boundary between that available water and the dry surface.”

Water tables can rise when they take on more water than they drain off. This can be from unusually high amounts of rain, or excess water from higher elevations. They are sometimes above the level of basement floors or crawlspaces. This may put your home at risk for flooding.

Watch for lingering puddles in your yard after a couple of days of heavy rain. It is very likely that the puddle is the top of the table and has temporarily exceeded what the yard can handle. There’s not much you can do to stop the flooding once it’s happening, but there are preventative measures that can be taken.

Basement and foundation waterproofing professionals, as well as landscaping contractors, can help homeowners develop a plan to mitigate water damage. This can include the installation of drains and pumps to move water away from the house. Special paints and sealants also can protect the foundation.

Do you have ample space in your yard for your bees? Are they allowed? Check your local zoning regulations first to make sure your city or town permits beekeeping.

Do you have ample space in your yard for your bees? Are they allowed? Check your local zoning regulations first to make sure your city or town permits beekeeping. Rain barrels collect water from your roof that runs from the gutter, through the downspout, and into your rain barrel. The collected water can be used to water your lawn and garden. Other used include wash your car, filling a koi pond, or cleaning around the house.

Rain barrels collect water from your roof that runs from the gutter, through the downspout, and into your rain barrel. The collected water can be used to water your lawn and garden. Other used include wash your car, filling a koi pond, or cleaning around the house. With 70% of the state of Massachusetts having had at least one COVID-19 vaccination, we are one of the highest vaccinated states in the country. That’s good news for gatherings. But if like most families hosting events, you’re probably not going to ask for proof of vaccinations as you welcome them into your home. So be safe, but have fun.

With 70% of the state of Massachusetts having had at least one COVID-19 vaccination, we are one of the highest vaccinated states in the country. That’s good news for gatherings. But if like most families hosting events, you’re probably not going to ask for proof of vaccinations as you welcome them into your home. So be safe, but have fun. OK, fine, gag me with a spoon! I’m not talking about a person, it’s a flowering plant that blooms in spring. It is also the official flower for those born in May.

OK, fine, gag me with a spoon! I’m not talking about a person, it’s a flowering plant that blooms in spring. It is also the official flower for those born in May.

First, let’s look at that saggy door. The culprit is typically a loose screw that may just need to be tightened. But after a few days you may see the door sag again. That’s because the screw has damaged the wood slightly. A quick fix that might solve your problem is to buy a bottle of

First, let’s look at that saggy door. The culprit is typically a loose screw that may just need to be tightened. But after a few days you may see the door sag again. That’s because the screw has damaged the wood slightly. A quick fix that might solve your problem is to buy a bottle of  To reduce odors from rugs and carpets, be sure to sprinkle some baking soda before vacuuming. This will neutralize the odors and leave your room fresher.

To reduce odors from rugs and carpets, be sure to sprinkle some baking soda before vacuuming. This will neutralize the odors and leave your room fresher.

No worries, we’ve got your back with a homemade slime recipe that’s easy and fun. Perfect ghoulish fun for the kiddos.

No worries, we’ve got your back with a homemade slime recipe that’s easy and fun. Perfect ghoulish fun for the kiddos.

As a non-toxic, natural cleaning agent, white vinegar is great for little jobs where either commercial cleaning products don’t exist, or they contain chemicals that may be less eco-friendly or less healthy for a house with small children and pets. Always remember, as with any cleaning agent, do a spot test on fabrics.

As a non-toxic, natural cleaning agent, white vinegar is great for little jobs where either commercial cleaning products don’t exist, or they contain chemicals that may be less eco-friendly or less healthy for a house with small children and pets. Always remember, as with any cleaning agent, do a spot test on fabrics.