Mortgage Broker vs. Big Bank: It’s Really Not a Fair Fight

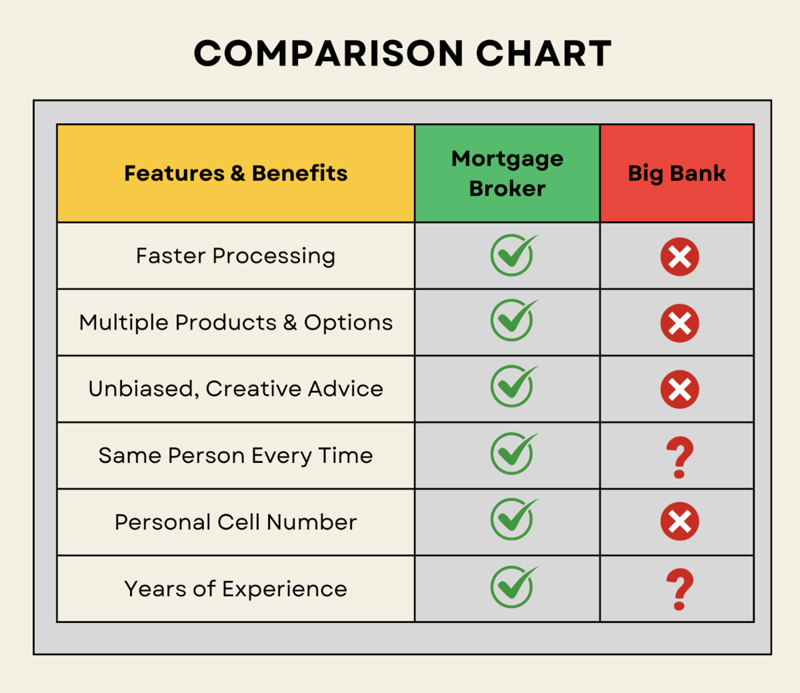

There’s so much more to consider when buying a home besides hunting down the best rates from a big bank. While big banks may seem like the obvious choice, mortgage brokers offer distinct advantages that can make your home buying process smoother and more personalized — and can compete with or beat big bank rates. It’s really not a fair fight.

One of the key benefits of working with an independent mortgage broker is the access to a wide range of products and options. Unlike big banks that have a limited selection, brokers can tap into multiple lenders to find a mortgage tailored to your specific needs. This variety ensures that you get the best possible terms for your financial situation.

Mortgage brokers are also known for their unbiased advice and innovative thinking. They are not tied to any one lender, allowing them to provide objective recommendations and find solutions that a big bank might overlook. This can be especially helpful for individuals with unique financial circumstances or credit issues.

More important, the personalized service you receive from a mortgage broker is unmatched. You work with the same person throughout the entire process, ensuring consistency and a deep understanding of your concerns. This dedicated attention can speed up processing times and reduce the stress associated with buying a home.

* * * * *

Ready to buy a new home or refinance the one you own? Please get in touch and I’ll be happy to answer your questions and help guide you through the process. I look forward to speaking with you.

Happy Fourth of July

The 4th of July is less than a week away. Are you hosting a party for friends and family? Here are a few red, white and blue treats to wow your guests.

- Vodka Lemon Slush. (Or hold the vodka for a non-alcoholic treat to beat the heat!) Get Recipe

- Red, White and Blue Fruit Cups. A quick and easy patriotic dessert from Rachael Ray. Get Recipe

- Firecracker Cupcakes. No, that’s not a real firecracker, it’s a red marshmallow and licorice. Get Recipe

- Berry-studded Flag Cake. Cupcakes too big an assignment? Try this easy sheet cake that would impress the founding fathers. Get Recipe

Happy Independence Day!

Home Improver: Rabbit Problems? Bring in the Flowers — and the Coyote Urine!

Dealing with hungry garden visitors like rabbits can challenge even the most patient of homeowners. If you’re looking to keep these veggie-eating critters at bay, consider planting certain flowers that naturally deter them.

Marigolds are typically the go-to for many gardeners. Their strong scent is off-putting to rabbits, and they add a splash of color to any garden. Lavender may give off a soothing aroma to humans, but for rabbits its potency acts as a repellent. Another option is the snapdragon; its bitter taste and tall, thick stalk makes them less appealing to your furry interlopers.

Marigolds are typically the go-to for many gardeners. Their strong scent is off-putting to rabbits, and they add a splash of color to any garden. Lavender may give off a soothing aroma to humans, but for rabbits its potency acts as a repellent. Another option is the snapdragon; its bitter taste and tall, thick stalk makes them less appealing to your furry interlopers.

Beyond planting deterrents, many gardeners consider the use of coyote urine. This method exploits the natural fear rabbits have of predators. Coyote urine can be effective in creating an invisible barrier that scares rabbits away. However, it needs frequent reapplication, especially after rain. Its use has been considered controversial by some, due to concerns about sourcing and animal welfare. If you’re curious about the process of collecting the urine (and who wouldn’t be?), here’s a short video.

So maybe just start with the flowers before choosing to turn your vegetable garden into a wicked pissah.

Preventing Water Damage: Gutters direct rainwater away from your home’s foundation, siding, and landscaping, preventing erosion and water damage. Without gutters, water can pool around your home and potentially leak into your basement or crawl space, causing significant damage over time.

Preventing Water Damage: Gutters direct rainwater away from your home’s foundation, siding, and landscaping, preventing erosion and water damage. Without gutters, water can pool around your home and potentially leak into your basement or crawl space, causing significant damage over time. First, get the smell out of the microwave itself: Fill a bowl with 1/2 cup water and 1 tablespoon white vinegar.

First, get the smell out of the microwave itself: Fill a bowl with 1/2 cup water and 1 tablespoon white vinegar. Convenience: during colder months: No more shoveling or snow blowing to clear a path to your garage or front door. The heat from the driveway melts snow and ice as soon as it falls, keeping your driveway clear and safe to walk on.

Convenience: during colder months: No more shoveling or snow blowing to clear a path to your garage or front door. The heat from the driveway melts snow and ice as soon as it falls, keeping your driveway clear and safe to walk on. Floral wallpaper, pastel sofas, lucite chairs and more are back in style as 1980s home decor trends have returned. Call it Miami Vice Revisited or Golden Girls Chic, these ’80s decor trends are making a big comeback to homes across the US.

Floral wallpaper, pastel sofas, lucite chairs and more are back in style as 1980s home decor trends have returned. Call it Miami Vice Revisited or Golden Girls Chic, these ’80s decor trends are making a big comeback to homes across the US. Sweep & Vacuum Hair and Dander. This may seem obvious and it may be something you do often, but to truly control odor, you have to find all the hiding spots for pet hair. This includes under couch cushions, below and inside drapery, under blankets and beds.

Sweep & Vacuum Hair and Dander. This may seem obvious and it may be something you do often, but to truly control odor, you have to find all the hiding spots for pet hair. This includes under couch cushions, below and inside drapery, under blankets and beds. These room refreshers have come a long way in recent years and they are reasonably priced for what they do. When used properly they can reduce household odors as well as common allergens that make you sick.

These room refreshers have come a long way in recent years and they are reasonably priced for what they do. When used properly they can reduce household odors as well as common allergens that make you sick.

No worries, we’ve got your back with a homemade slime recipe that’s easy and fun. Perfect ghoulish fun for the kiddos.

No worries, we’ve got your back with a homemade slime recipe that’s easy and fun. Perfect ghoulish fun for the kiddos.