The 50-Year Mortgage: A New Path to Affordability or a Long-Term Financial Risk?

President Trump’s recent suggestion of a 50-year mortgage has sparked some conversation in the housing market. For first-time buyers and those feeling priced out, the idea of a lower monthly payment is appealing. But what exactly would a 50-year mortgage look like? And how does it compare to the long-standing 30-year fixed mortgage?

A 50-year mortgage would extend home loan repayment to 600 monthly payments, compared with the 360 payments of a traditional 30-year mortgage. The main goal behind this proposal is to make monthly payments more manageable by spreading the loan over a longer period, potentially making homeownership feel more accessible. However, it’s important to note that at this time, a 50-year mortgage is only hypothetical in the U.S. Major government-backed lenders like Fannie Mae and Freddie Mac do not offer loans longer than 30 years, and widespread availability would require changes in federal regulations.

When evaluating any mortgage, it’s crucial to balance the short-term benefit of a lower monthly payment against the long-term cost of interest and the speed at which you build equity—the portion of your home you actually own.

50-Year vs. 30-Year Mortgages: Pros and Cons

Monthly Payment: A 50-year mortgage offers a lower monthly payment, making it easier to qualify and freeing up cash flow. The 30-year mortgage requires a larger monthly budget but allows equity to grow faster.

Total Interest Paid: Stretching a mortgage to 50 years means paying interest for two extra decades, potentially nearly doubling the total interest over the life of the loan. A 30-year loan results in much lower total interest.

Equity Growth: With a 50-year term, early payments go mostly toward interest, so equity builds very slowly. In contrast, a 30-year mortgage allows equity to grow steadily, helping homeowners build wealth faster.

Long-Term Risk: A 50-year mortgage ties you to debt for half a century. If home values fall, slow equity growth increases the risk of owing more than the home is worth. A 30-year term reduces long-term exposure and aligns better with retirement planning.

Interest Rate: Longer-term loans generally carry higher interest rates to compensate lenders for increased risk. A 30-year mortgage typically has a lower rate than a hypothetical 50-year option.

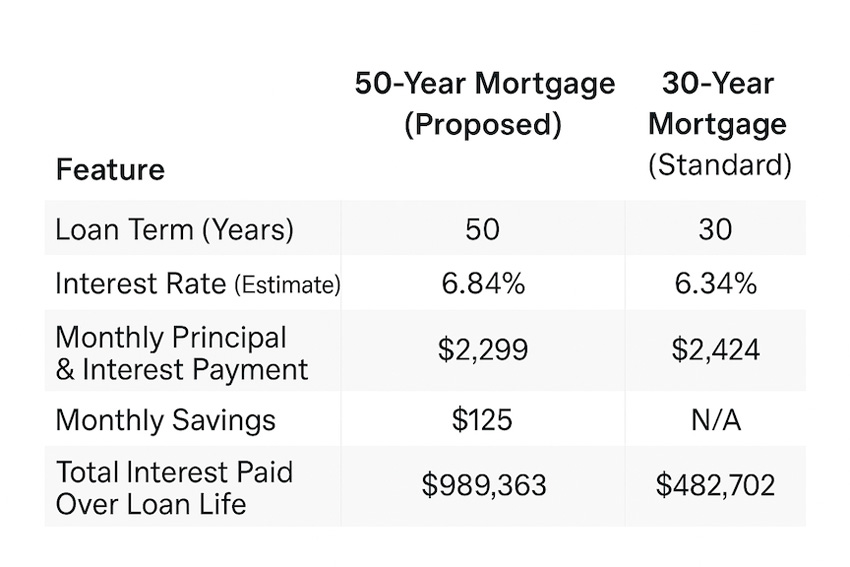

To illustrate, here’s a comparison based on a $450,000 home with a $390,000 loan:

These numbers show that while the monthly payment difference may seem attractive, the total cost over the life of a 50-year loan is substantially higher. Actual payments could vary depending on interest rates, and many homeowners refinance or move before 30 years, which would alter the long-term impact.

Currently, the 30-year fixed-rate mortgage remains the standard in the U.S., and loans longer than 30 years are rare and usually private, with stricter requirements. For most buyers, especially those likely to move or refinance within a decade, a shorter-term mortgage is a more effective tool for building generational wealth. A 50-year mortgage may make it easier to “get in the door,” but staying there comes at a substantial financial cost.

If you’re planning to start your homebuying journey now or into early 2026, please reach out. I’ll help you get prepped and positioned so you can move quickly and confidently to find your dream home.

Home Improver: Prep Your Winter Tools Now

Don’t wait for the first big snowfall to discover your snow blower won’t start or your shovel blade is dull. A little prep now will save you time, effort and possibly an expensive repair in the middle of a New England storm.

1. Tune-Up Your Snow Blower

1. Tune-Up Your Snow Blower

Your snow blower is the most complex piece of equipment and requires the most attention:

- Fuel First: Empty any stale, old gasoline. Refill with fresh, good-quality gasoline and add a fuel stabilizer to ensure easy starting.

- Change the Oil: If you have a 4-cycle model (separate fuel and oil), replace the engine oil now to protect the engine.

- Inspect and Lubricate: Check the drive belt for wear. Lubricate the auger shaft and bearings to prevent seizing.

2. Sharpen Your Shovels and Scrapers

A sharp, clean edge makes snow removal significantly easier, especially for scraping hard-packed snow and ice.

- Sharpen the Edge: Use a metal file to put a slight angle on the front of the blade. This helps the blade slice through snow and ice more effectively.

- Prevent Sticking: Spray the metal blade with a coat of silicone lubricant or a quick wax. This helps the snow slide off instead of sticking, making the job lighter and protecting the metal from corrosion.

3. Prep Your Ice Melt Supplies

Having the right ice melt on hand protects your family from slips and your property from damage.

- Choose Wisely: Remember that common Rock Salt (Sodium Chloride) stops working effectively at about 20º F and can damage concrete and pet paws. Consider a safer alternative like Magnesium Chloride or the environmentally friendly Calcium Magnesium Acetate (CMA).

- Buy Early and Store: Stock up now before the first big rush and store your supplies in a dry, accessible container.