My Top 5 Predictions for the 2026 Mortgage and Housing Market

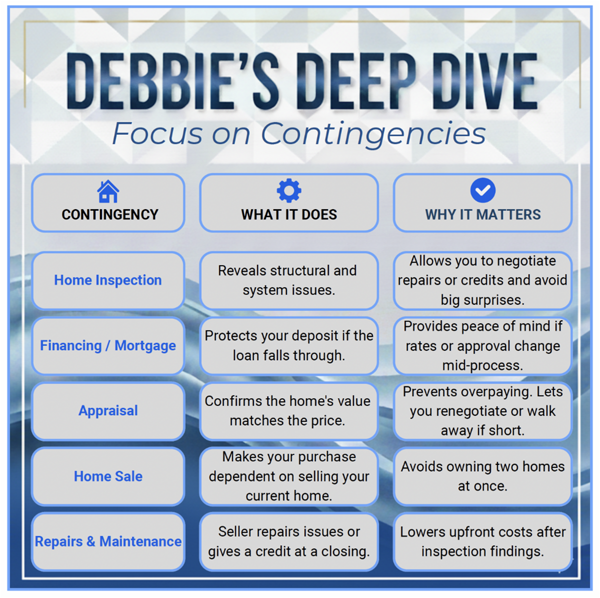

1. The “Walk-Away” Trend Hands Leverage to Buyers

We’ve seen a record number of homebuyers (nearly 16%) cancel contracts recently, according to MPA Mag and Redfin. For you, this means the “frenzy” is officially over. Buyers are no longer willing to overlook structural issues or high repair costs just to close. Because more homes are coming on the market with fewer competing offers, you have the power to be selective. If a seller won’t budge on an repair, you have the leverage to walk away and find a better option.

2. A Shift in Federal Reserve Leadership

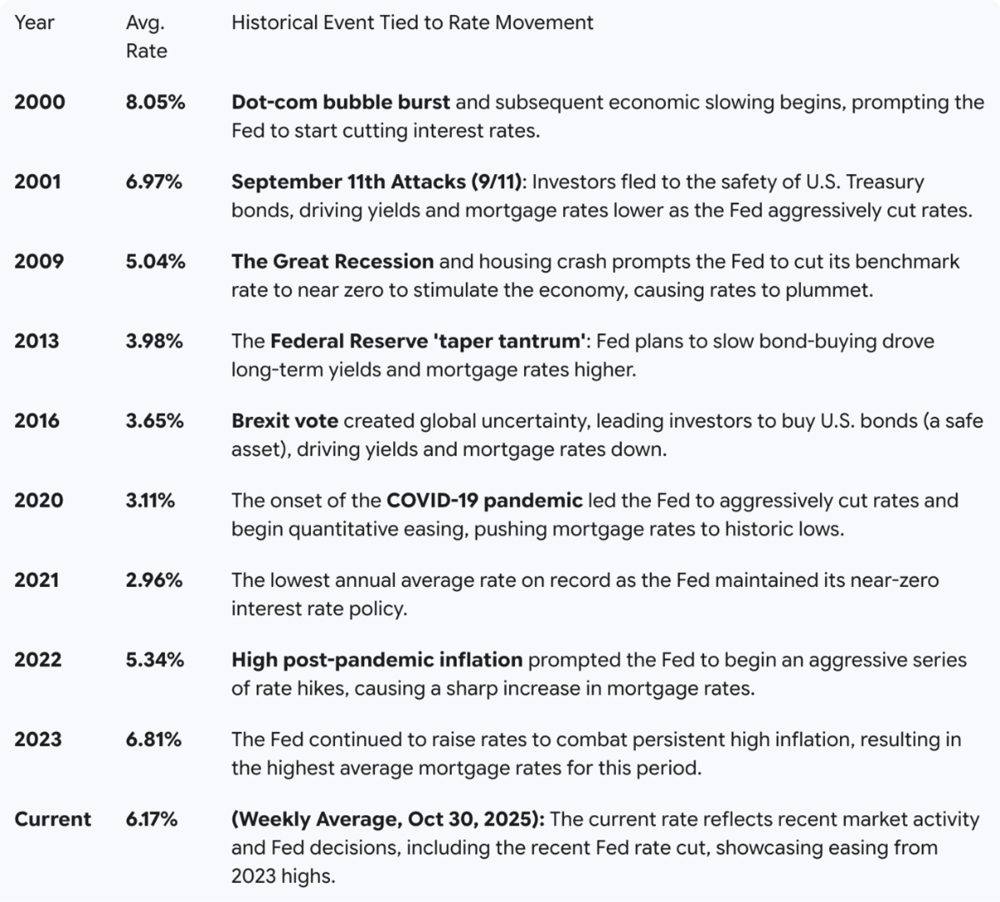

With President Trump’s vocal dissatisfaction with Jerome Powell, I predict a new Fed Chair will be nominated in the next week to replace Powell, whose term expires in May. A leadership change often signals a shift in strategy. We could see a more aggressive push to lower interest rates to stimulate growth, which would directly impact your borrowing costs and the overall pace of the market.

3. The 30% Affordability Reset

For years, the math has been tough, with mortgage payments often exceeding 30% of household income. I agree with forecasts from Redfin that 2026 is the year we fall back below that threshold. As wages rise and rates stabilize, the “affordability gap” is finally shrinking. This should help make homeownership feel like a reachable goal again rather than a daunting financial strain.

4. A Surge in Tactical Refinancing

If you bought your home between 2023 and 2025 with a rate in the 7% or 8% range, 2026 is likely your year. While we won’t see 3% again, many analysts expect rates to settle in the high 5s or low 6s. This creates a perfect “sweet spot” for a tactical refinance, potentially saving you hundreds of dollars per month.

5. The Rise of Cost-Saving Home Features

Home shoppers are now looking beyond the sticker price. Based on recent research, I predict high demand for homes that lower your daily cost of living. Features like walk-in pantries for bulk buying, whole-home batteries, and EV charging stations are becoming “must-haves.” Buyers are looking for properties that protect their wallets from future inflation.

If you’re planning to start your homebuying journey now or into early 2026, please reach out. I’ll help you get prepped and positioned so you can move quickly and confidently to find your dream home.

Home Improver: Refresh Your Rooms with Fixtures and Hardware

You don’t need a full-scale renovation to give your home a high-end, modern feel. Often, the most effective strategy is to update the “jewelry” of your home: the lighting and hardware. Swapping out dated builder-grade fixtures for contemporary alternatives can completely transform both the aesthetic and functionality of your kitchen or bathroom. Get ready to impress your guests without breaking the bank.

The Art of Mixing Metals

The Art of Mixing Metals

The rule that every handle and faucet must match is still valid, but it’s no longer the only option. Mixing two or three finishes adds professional-level dimension to a room. Try pairing matte black hardware with warm brass lighting for a bold look, or combine chrome with brushed nickel for something more subtle and sleek.

Layering Your Light

Good lighting is about more than just visibility; it’s about mood. Avoid relying on a single overhead bulb, which creates harsh shadows. Instead, layer your light:

- Task Lighting: Under-cabinet LED strips brighten your workspace and make meal prep safer.

- Ambient Lighting: Dimmable recessed lights or a statement chandelier set the overall tone.

- Accent Lighting: Wall sconces or small spotlights can highlight architectural details or your favorite artwork.

High-Impact Hardware

Replacing tarnished cabinet knobs and pulls is one of the easiest DIY projects with the highest visual return on investment. For an instant update, look for sleek, geometric designs or knurled metal handles. These small changes provide a tactile sense of quality every time you open a drawer or cabinet.

1. Tune-Up Your Snow Blower

1. Tune-Up Your Snow Blower

As these tiny pieces settle into the turf, they decompose over the winter, returning valuable nutrients like nitrogen and phosphorus back to your soil. This simple practice helps improve soil structure, suppresses early spring weeds like dandelions, and significantly reduces the amount of expensive fertilizer you will need next spring.

As these tiny pieces settle into the turf, they decompose over the winter, returning valuable nutrients like nitrogen and phosphorus back to your soil. This simple practice helps improve soil structure, suppresses early spring weeds like dandelions, and significantly reduces the amount of expensive fertilizer you will need next spring.

Let’s stay ahead of this. Here’s your checklist:

Let’s stay ahead of this. Here’s your checklist: Did you know your ceiling fans can help lower heating costs? Most people think of ceiling fans as a summertime necessity, but they can actually help you stay warmer in the cooler months, too. The secret is in the small switch on the motor housing that changes the blade direction.

Did you know your ceiling fans can help lower heating costs? Most people think of ceiling fans as a summertime necessity, but they can actually help you stay warmer in the cooler months, too. The secret is in the small switch on the motor housing that changes the blade direction.

Did you know that

Did you know that

Reduce Humidity: Silverfish love moisture, so use a dehumidifier in damp areas like basements, bathrooms, and laundry rooms. Fix any leaky pipes or faucets to cut off their water supply.

Reduce Humidity: Silverfish love moisture, so use a dehumidifier in damp areas like basements, bathrooms, and laundry rooms. Fix any leaky pipes or faucets to cut off their water supply. Weather Stripping: Apply adhesive weather-stripping tape around door and window frames. This simple solution seals gaps and stops drafts, making your home more energy-efficient.

Weather Stripping: Apply adhesive weather-stripping tape around door and window frames. This simple solution seals gaps and stops drafts, making your home more energy-efficient. Switch to Orange Light Bulbs

Switch to Orange Light Bulbs